You signed in with another tab or window. Reload to refresh your session.You signed out in another tab or window. Reload to refresh your session.You switched accounts on another tab or window. Reload to refresh your session.Dismiss alert

description: Receive AUD reimbursements from an Australian employer by adding your banking information

4

4

---

5

+

5

6

<divid="expensify-classic"markdown="1">

6

7

7

-

{% include info.html %}

8

-

The workspace must be set to AUD to use ABA batch reimbursements. For businesses that will also be reimbursing employees in other countries outside of Australia, you’ll need to set up Global Reimbursement instead.

9

-

{% include end-info.html %}

8

+

Australian employees can connect a personal deposit-only bank account to receive reimbursements for their expense reports.

9

+

10

+

**Important Notes:**

11

+

- The workspace currency must be set to AUD to use ABA batch reimbursements.

12

+

- If your company reimburses employees in multiple countries, set up **[Global Reimbursement](https://help.expensify.com/articles/expensify-classic/bank-accounts-and-payments/bank-accounts/Enable-Global-Reimbursements)** instead.

13

+

14

+

---

15

+

16

+

# Add the Bank Account

17

+

18

+

1. Click your profile picture and select the workspace you want set as your default workspace.

19

+

2. Hover over **Settings**, then click **Account**.

20

+

3. Click the **Payments** tab.

21

+

4. Click **Add Deposit-Only Bank Account**.

22

+

5. Enter the required details:

23

+

-**Account Holder Information**: Name, address, city, and country.

24

+

-**Bank Details**: SWIFT code, bank name, address, and city.

25

+

-**Account Information**: Account number and BSB number.

26

+

6. Click **Save & Continue**.

10

27

11

-

Australian employees can connect a personal deposit-only bank account to receive reimbursements for their expense reports.

28

+

## Troubleshooting Steps

12

29

13

-

1. Click your profile picture and select the workspace you want to set as your default workspace.

14

-

2. Hover over **Settings**, then click **Account**.

15

-

3. Click the **Payments** tab on the left.

16

-

4. Click **Add Deposit-Only Bank Account**.

17

-

5. Enter the company information.

18

-

- Enter the account holder’s name, address, city, and country.

19

-

- Enter the swift code.

20

-

- Enter the bank’s name, address, and city.

21

-

- Enter the account number.

22

-

- Enter the BSB number.

30

+

- If you don’t know your **Bank User ID/Direct Entry ID/APCA Number**, contact your bank.

31

+

- If you don’t see the required fields, your company hasn’t enabled reimbursements through Expensify. Contact your administrator for next steps.

32

+

33

+

---

23

34

24

-

{% include info.html %}

25

-

If you don’t know your Bank User ID/Direct Entry ID/APCA Number, contact your bank for this information.

35

+

# FAQ

26

36

27

-

If your screen does not contain the listed fields, your company hasn’t enabled reimbursements through Expensify. Contact your administrator for next steps.

28

-

{% include end-info.html %}

37

+

## Why don’t I see the option to add a deposit-only bank account?

38

+

If your company hasn’t enabled reimbursements in Expensify, you won’t see this option. Contact your administrator for assistance.

29

39

30

-

{:start="6"}

31

-

6. Click **Save & Continue**.

40

+

## What if I don’t know my Bank User ID?

41

+

Your bank can provide this information. Contact them to confirm your **Bank User ID/Direct Entry ID/APCA Number**.

32

42

33

-

</div>

43

+

## Can I add multiple bank accounts?

44

+

No, you can only add one deposit-only bank account per workspace for reimbursements.

Copy file name to clipboardExpand all lines: docs/articles/expensify-classic/bank-accounts-and-payments/bank-accounts/Connect-Personal-Bank-Account.md

+27-20

Original file line number

Diff line number

Diff line change

@@ -2,40 +2,47 @@

2

2

title: Connect personal bank account

3

3

description: Receive reimbursements for expense reports submitted to your employer

4

4

---

5

+

5

6

<divid="expensify-classic"markdown="1">

6

7

7

-

Employees can connect a personal deposit-only bank account to receive reimbursements for their expense reports.

8

+

Employees can connect a personal deposit-only bank account to receive reimbursements for their expense reports.

9

+

10

+

---

8

11

9

-

To connect a deposit-only account,

12

+

# Connect a Deposit-only Bank Account

10

13

11

14

1. Hover over **Settings**, then click **Account**.

12

15

2. Click the **Payments** tab on the left.

13

16

3. Click **Add Deposit-Only Bank Account**, then click **Connect to your bank**.

14

17

4. Click **Continue**.

15

-

5. Search for your bank account in the list of banks and follow the prompts to sign in to your bank account.

16

-

- If your bank doesn’t appear, click the X in the right corner of the Plaid pop-up window, then click **Connect Manually**. You’ll then manually enter your account information and click **Save & Continue**.

17

-

6. Click **Save & Continue**.

18

-

7. Enter the name, address, and phone number associated with the account. Then click **Save & Continue**.

18

+

5. Search for your bank account in the list of banks

19

+

6. Follow the prompts to sign in to your bank account using the corresponding username and password.

20

+

- If your bank doesn’t appear, click the **X** in the right corner of the Plaid pop-up window, then click **Connect Manually**. You’ll then manually enter your account information and click **Save & Continue**.

21

+

7. Enter the name, address, and phone number associated with the account

22

+

8. Click **Save & Continue**.

19

23

20

-

You’ll now receive reimbursements for your expense reports and invoices directly to this bank account.

21

24

22

-

{% include info.html %}

23

-

If your organization has global reimbursement enabled and you want to add a bank account outside of the US, you can do so by following the steps above. However, after clicking on **Add Deposit-Only Bank Account**, look for a button that says **Switch Country**. This will allow you to add a deposit account from a supported country and receive reimbursements in your local currency.

24

-

{% include end-info.html %}

25

+

Once the bank account is connected to your Expensify account, future reimbursements will be deposited directly.

25

26

26

-

{% include faq-begin.md %}

27

+

## Using Global Reimbursement

27

28

28

-

**I connected my deposit-only bank account. Why haven’t I received my reimbursement?**

29

+

If your organization has global reimbursement enabled and you want to add a bank account outside the US, follow the steps above.

29

30

30

-

There are a few reasons why you might not have received a reimbursement:

31

-

- The estimated deposit date on the report has not arrived yet.

32

-

- The bank account information is incorrect. If you believe you may have entered the wrong account, contact the Concierge and provide the Report ID for the missing reimbursement.

33

-

- Your account wasn’t set up for Direct Deposit/ACH. You can contact your bank to confirm.

31

+

After clicking **Add Deposit-Only Bank Account**, under **Settings > Accounts > Payments**, click **Switch Country** at the top of the bank selection screen. This will allow you to add a deposit account from a supported country and receive reimbursements in your local currency.

34

32

35

-

**What happens if my bank requires an additional security check before adding it to a third party?**

33

+

---

34

+

35

+

# FAQ

36

+

37

+

## I connected my deposit-only bank account. Why haven’t I received my reimbursement?

38

+

39

+

Check the following possible issues:

40

+

- The estimated deposit date on the report has not arrived yet.

41

+

- The bank account information is incorrect. If you believe you may have entered the wrong account, contact **Concierge (Expensify’s support team)** and provide the **Report ID** for the missing reimbursement.

42

+

- Your bank account isn’t set up for **Direct Deposit/ACH** — please contact your bank to confirm.

36

43

37

-

If your bank account has two-factor authentication (2FA) or another security step enabled, you should be prompted to complete this authentication step when connecting the account to Expensify. However, if you encounter an error during this process, you can close the pop-up window and select Connect Manually to add the account manually.

44

+

## What happens if my bank requires an additional security check before adding it to a third party?

38

45

39

-

{% include faq-end.md %}

46

+

If your bank account has **two-factor authentication (2FA)** or another security step enabled, you should be prompted to complete this authentication step when connecting the account to Expensify.

40

47

41

-

</div>

48

+

However, if you encounter an error during this process, you can close the pop-up window and select **Connect Manually** to add the account manually.

Copy file name to clipboardExpand all lines: docs/articles/expensify-classic/bank-accounts-and-payments/payments/Receive-and-Pay-Bills.md

+20-13

Original file line number

Diff line number

Diff line change

@@ -1,15 +1,18 @@

1

1

---

2

2

title: Receive and Pay Bills

3

3

description: Expensify bill management and payment methods.

4

+

keywords: Bill pay, pay vendors, invoice, vendor bills

4

5

---

5

6

6

-

Easily receive and pay vendor or supplier bills directly in Expensify. Your vendors don’t even need an Expensify account! Manage everything seamlessly in one place.

7

+

Easily receive and pay vendor or supplier bills directly in Expensify. Your vendors don’t need an Expensify account to manage everything in one place!

8

+

9

+

---

7

10

8

11

# Receiving Bills

9

12

10

13

Expensify makes it easy to receive bills in three simple ways:

11

14

12

-

###1. Directly from Vendors

15

+

## 1. Directly from Vendors

13

16

Share your Expensify billing email with vendors to receive bills automatically.

14

17

15

18

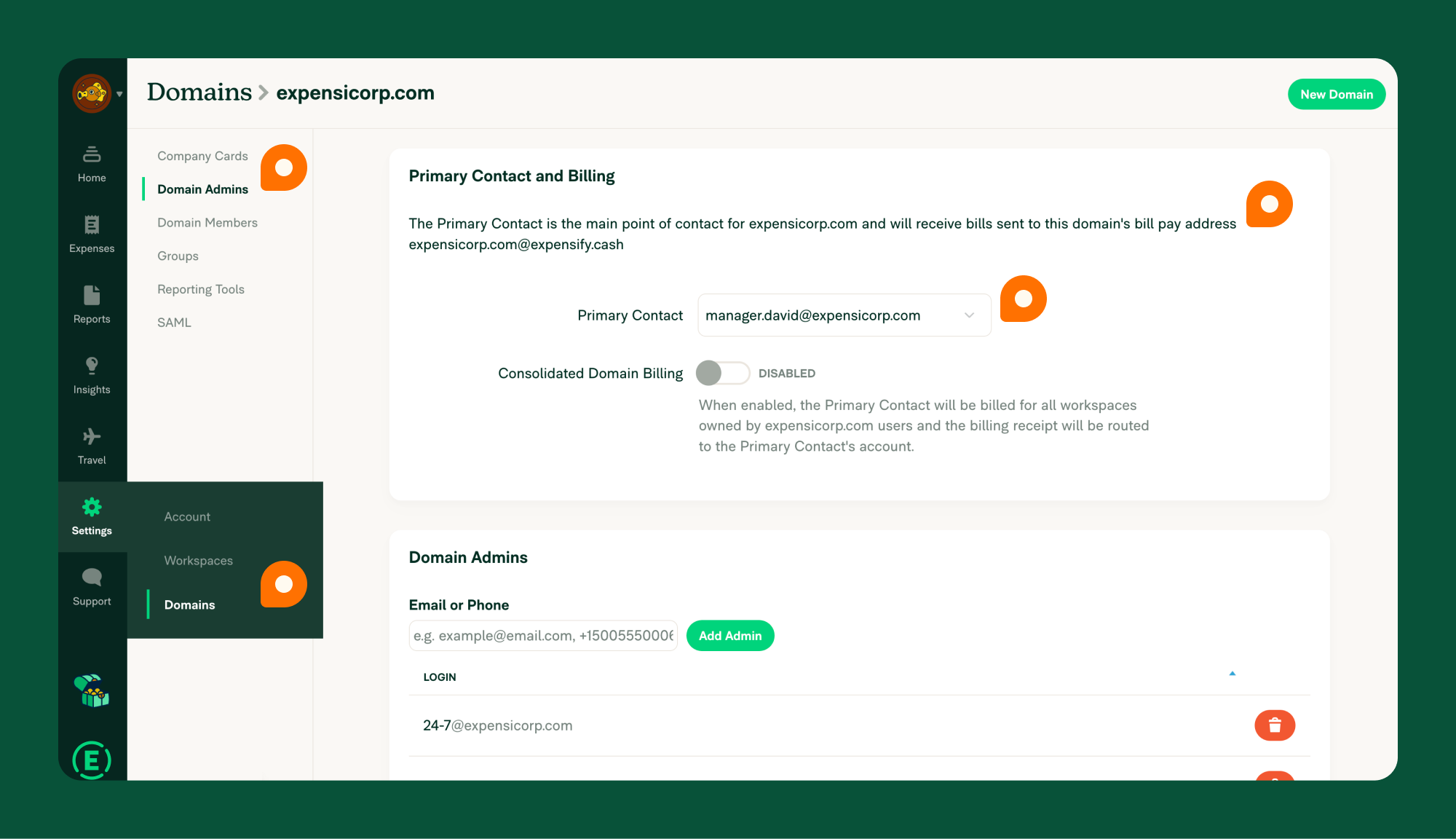

- Set a Primary Contact under **Settings > Domains > Domain Admins**.

@@ -18,14 +21,14 @@ Share your Expensify billing email with vendors to receive bills automatically.

18

21

19

22

{:width="100%"}

20

23

21

-

###2. Forwarding Emails

22

-

Received a bill in your email? Forward it to Expensify.

24

+

## 2. Forwarding Emails

25

+

If you received a bill in via email, you can forward it directly to Expensify.

23

26

24

27

- Ensure your Primary Contact is set under **Settings > Domains > Domain Admins**.

25

28

- Forward bills to `domainname@expensify.cash`. Example: `domainname@expensify.cash` (e.g., for *expensicorp.com*, use `expensicorp@expensify.cash`).

26

29

- Expensify will create a bill automatically, ready for payment.

27

30

28

-

###3. Manual Upload

31

+

## 3. Manual Upload

29

32

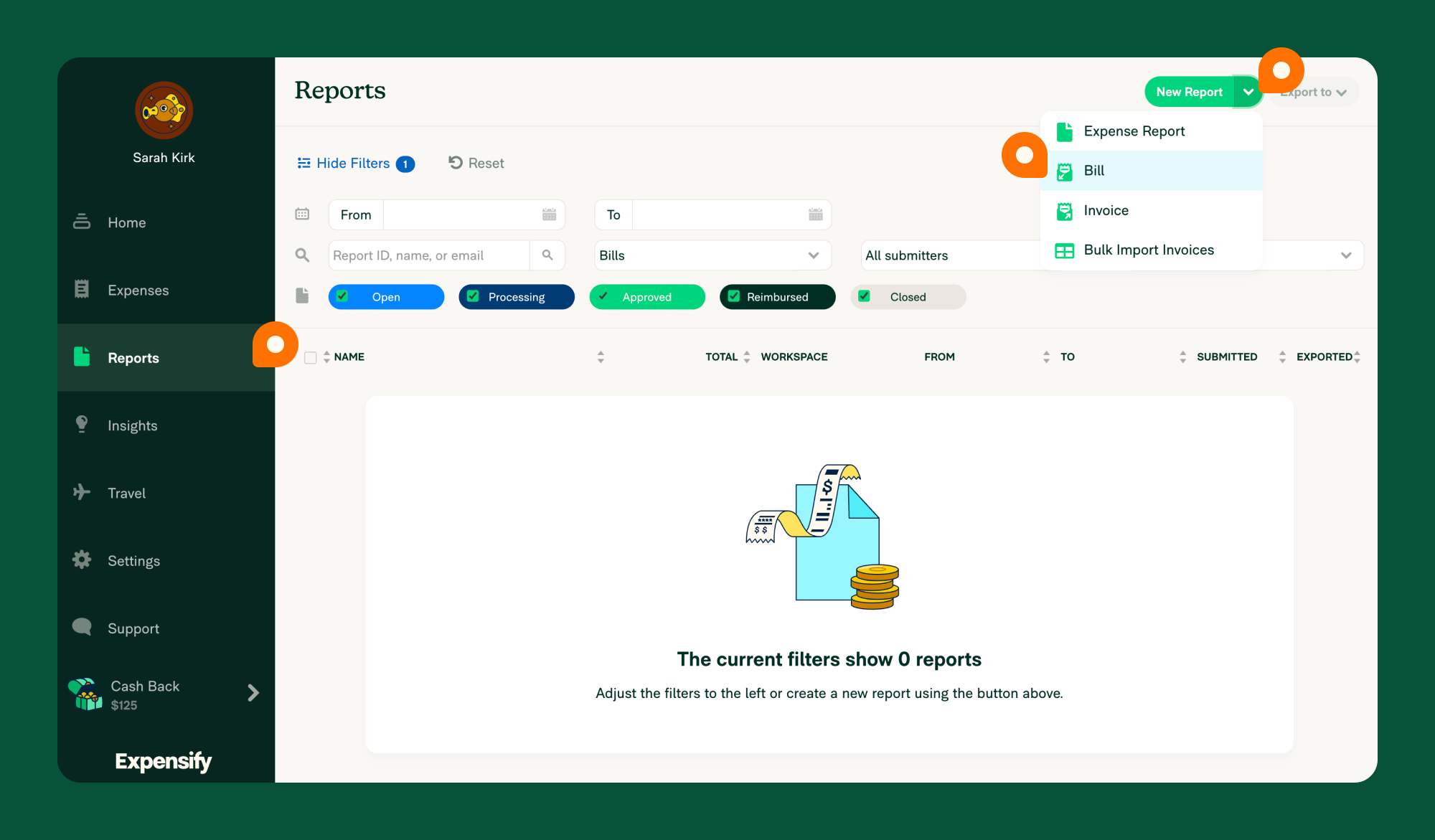

Got a paper bill? Create a bill manually in [Expensify](https://www.expensify.com/):

30

33

31

34

1. Log in to [Expensify](https://www.expensify.com).

@@ -35,6 +38,8 @@ Got a paper bill? Create a bill manually in [Expensify](https://www.expensify.co

35

38

36

39

{:width="100%"}

37

40

41

+

---

42

+

38

43

# Paying Bills in Expensify

39

44

40

45

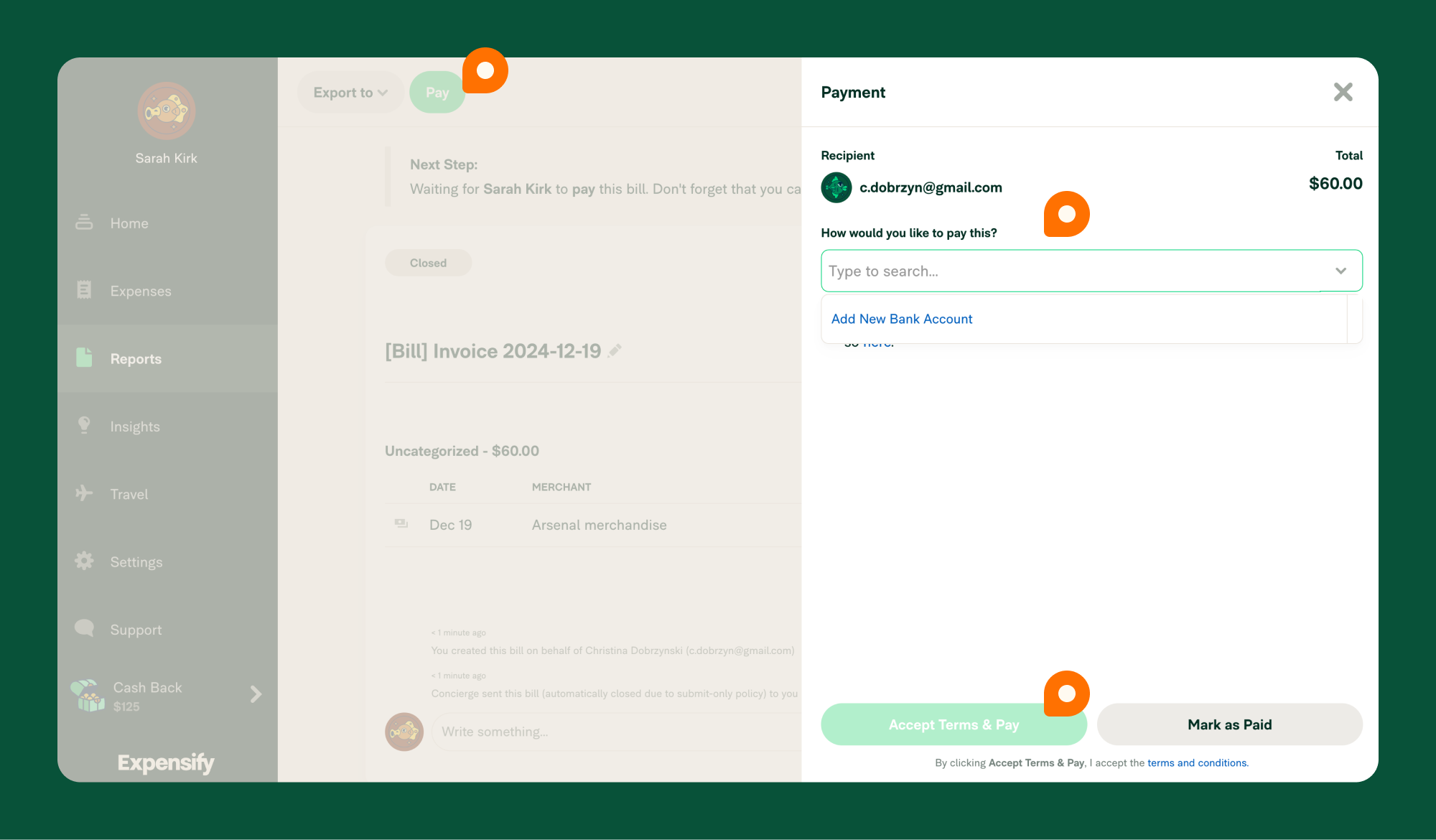

Expensify makes it easy to manage and pay vendor bills with a straightforward workflow and flexible payment options. Here’s how it works:

@@ -49,11 +54,13 @@ Expensify makes it easy to manage and pay vendor bills with a straightforward wo

49

54

50

55

{:width="100%"}

51

56

52

-

## Payment Methods

57

+

---

58

+

59

+

# Payment Methods

53

60

54

61

Expensify offers several ways to pay bills. Choose the method that works best for you:

55

62

56

-

###1. ACH Bank-to-Bank Transfer

63

+

## 1. ACH Bank-to-Bank Transfer

57

64

58

65

Fast and fee-free, this method requires a connected [business bank account](https://help.expensify.com/articles/expensify-classic/bank-accounts-and-payments/bank-accounts/Connect-US-Business-Bank-Account).

59

66

@@ -66,7 +73,7 @@ Fast and fee-free, this method requires a connected [business bank account](http

66

73

67

74

---

68

75

69

-

###2. Credit or Debit Card

76

+

## 2. Credit or Debit Card

70

77

71

78

Pay vendors using a credit or debit card. This option is available for US and international customers paying US vendors with a US business bank account.

72

79

@@ -79,15 +86,15 @@ Pay vendors using a credit or debit card. This option is available for US and in

79

86

80

87

---

81

88

82

-

###3. Venmo

89

+

## 3. Venmo

83

90

84

91

If both you and the vendor have Venmo accounts connected to Expensify, you can pay through Venmo. Learn how to set up Venmo [here](https://help.expensify.com/articles/expensify-classic/bank-accounts-and-payments/Third-Party-Payments#setting-up-third-party-payments).

85

92

86

93

**Fees:** Venmo charges a 3% sender’s fee.

87

94

88

95

---

89

96

90

-

###4. Pay Outside Expensify

97

+

## 4. Pay Outside Expensify

91

98

92

99

If you prefer to pay outside Expensify, you can still track the payment within the platform.

93

100

@@ -98,7 +105,9 @@ If you prefer to pay outside Expensify, you can still track the payment within t

98

105

99

106

**Fees:** None.

100

107

101

-

{% include faq-begin.md %}

108

+

---

109

+

110

+

# FAQ

102

111

103

112

## Who receives vendor bills in Expensify?

104

113

@@ -119,5 +128,3 @@ Currently, payments are only supported in USD.

119

128

## What's the difference between a bill and an Invoice in Expensify?

120

129

121

130

A bill represents a payable amount owed to a vendor, while an Invoice is a receivable amount owed to you.

0 commit comments